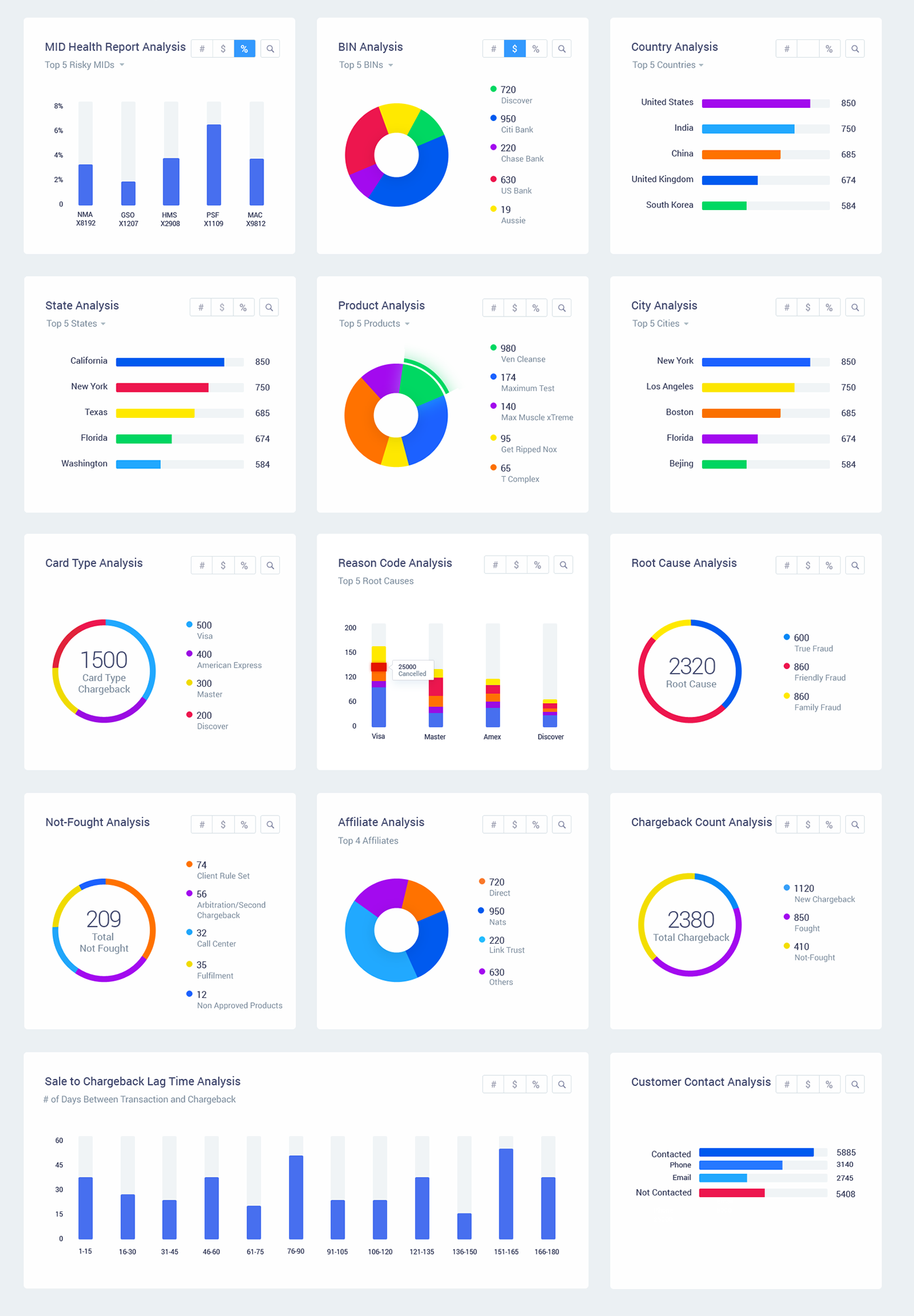

Each report includes:

industry revenue;

industry profit;

industry margin;

industry employment;

industry major players;

industry key external drivers;

industry product & structure segmentation;

industry key trends;

industry Life Cycle;

industry Geographic Breakdown;

industry Key Success Factors;

industry Key statistics for previous years;

forecast of industry Key statistics for the next 5 years;

Collapsible content

Reference Wordlist

Colloquial Terminology

Details

We offer a wide range of reports at an affordable price and make it easy for customers to choose between packages that are tailored to their needs.

Get a comprehensive insight of the US market with these reports.

-

In-depth information on different industries and sectors, such as retail, education, and healthcare.

-

Explore opportunities to enter the US markets with these in-depth reports. Learn more about the market potential before you invest

-

Gives you insights of all aspects of the United States market, from retail to education to healthcare.

industry-stat.com

Online marketplace for business intelligence and market research reports. We offer a wide range of reports on various industries and countries to satisfy all your business needs.